Budgeting: What is it and Why is it Important

As per Wikipedia, budget (derived from the French word bougette, meaning purse) is a quantified financial plan for a forthcoming accounting period. The process of arriving at this plan is called Budgeting. Simply put, budgeting is making estimates of one’s future inflows and outflows for a specific period of time and ensuring the availability of sufficient funds to perform desired activities. The revenues and expenditures can be estimated on a periodic basis, say monthly, quarterly or yearly and summarized in a spending plan based on previous trends.

The importance of budgeting cannot be over-emphasized, be it at a personal, corporate or government level. Individual, corporations and governments are faced with similar challenges in the form of scarcity of resources and highly unpredictable futures. Thus it becomes imperative not only to think and plan ahead but also to prioritize. Thus the significance of budgeting as a planning and controlling tool is crucial. Budgeting requires a clear bifurcation between needs and wants. It is a tool for ensuring that the needs are firstly met without jeopardizing the individual’s or company’s sustainability.

Personal Budget

On personal level, when incomes are limited and usually restricted to one earning member of a family, budgeting ensures that the basic needs and expenses like housing, education, utilities and grocery are given priority and catered to. In today’s world, where competitions are tough and layoffs are highly anticipated across all levels and industries, budgeting can help meet not only the current needs but ensure that savings are kept aside for any unforeseen calamity. Devising a spending plan can ensure that the household does not run into a debt or can actually help in strategizing a way out of an existing debt. More often than not, the tasks falls on the wives/ mothers who master the art of budgeting while running their households.

Budgeting does not necessarily mean missing out on your wants and curbing your wish lists. On the contrary, it helps in devising a sound and strategic plan to go about the finances in an optimal fashion; ensuring spending within available limits, with a penchant for saving as well.

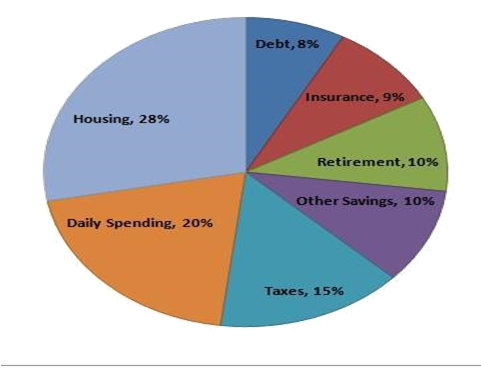

Graphically a personal budget can be represented as follows:

Corporate / Government Budgets

Similar is the case with corporations and governments when tasked with budgeting but on a macro level.

There are multiple facets to budgeting in an organization where respective divisions and departments including human resources, IT, operations, marketing, sales etc are tasked with making their respective departmental budgets. The main aspects of these budgets based on past figures are:

- Estimating future revenues and sales;

- Estimating future expenses and disbursements

- Prioritizing activities

The past trends assist the departments in making fair judgments of when to anticipate high or low sales volumes including which periods would require extravagant outflows of cash. The departmental budgets are then rolled out into a master corporate budget.

Corporations usually make two types of budgets: static and flexible one. In the static budget, the figures for sales and revenues, cost and expenditures, assets and liabilities remain constant. Such a budget helps the organization to compare the actual performance of sales and expenses against the estimated projections and measure variance. The flexible

budget gives room for updating the projected estimates as events unfold and corporations are able to make more reliable and realistic assumptions.

In the absence of a budget, companies are usually clueless and shooting in the dark. A budget helps in monitoring the company’s performance. If the actual sales generated and costs incurred are in line with the budgeted estimates, it portrays that the management knows its game and can accurately predict external variables affecting its work environment. However, if the budget estimates vary greatly from the actual figures, the management needs to stringently revisit the assumptions used to generate the budget as well as re-evaluate the surrounding environment for factors having positive as well as negative impact on its operations.

Budgets are inevitable in helping corporations operate effectively and efficiently. A surplus budget indicates that a company anticipates profits at year/ period end. This allows room for investments or capital expenditures and builds up on the earning per share and projects a company’s positive image. A balanced budget indicates that the company anticipates breaking even. Whereas deficit budget estimates the expenses to exceed the revenues. Such a budget allows the companies to look for avenues to secure debt in case it foresees a deficit for meeting operational requirements or capital expenditures.

Categorically, the most important budgets prepared by corporations are:

Sales budget: estimates of the forecasted sales usually in terms of number of units as well as value.

Capital Budget: estimates of the company’s investments in fixed assets, machinery, research projects etc.

Cash Budget: estimates of company’s cash receipts and expenses usually assisting in meeting the working capital requirements.

Similarly, governments task the finance ministers to make budgets based on estimated tax revenues, export incomes and probable outflows for development expenditures and import payments broadly speaking.

Thus budgeting plays a pivotal role in ensuring that cash management for any individual, corporation, government is streamlined and any anticipated challenges are timely addressed.

By: Amina Tariq, ACA

Amina Tariq, a qualified chartered accountant who is open to accepting new challenges.

Her experience ranges from aviation industry to audits across multiple sectors.