“When women participate in the economy everyone benefits”

(Hillary Clinton)

Those who favor diversity perceive that women recruitment on board is a “strategic necessity”. Women can make specific contribution to an organization. A multilevel analysis of a large US dataset shows that there is indeed a large and robust difference between male and female personalities.

Females score higher on sensitivity, warmth, apprehension, and more risk adverse

Vs.

Men score higher on emotional stability, dominance, rule consciousness, and vigilance.

Equality between women and men is always in discussion especially when it comes to employment and occupation. Women have been struggling for the opportunity to break into company boardrooms in the developed and developing countries across since last quarter of twentieth century. However, female board members remain in the minority, their numbers are steadily growing. That is one of the reasons that some countries make it as part of corporate law to adopt a considerable number of directives on matters such as equal treatment in employment and occupation.

In 2003, Norway was the first country introduce 40 percent women quota on listed companies board followed by France (33 percent) and Germany (30 percent) among others. This is emerging trend and rest of the countries including Asian countries such as Pakistan, India, Malaysia etc. has followed this rule for listed companies to have women on board in their code of corporate governance regulation where women hold just one in eight seats on the boards of Asia’s largest public companies.

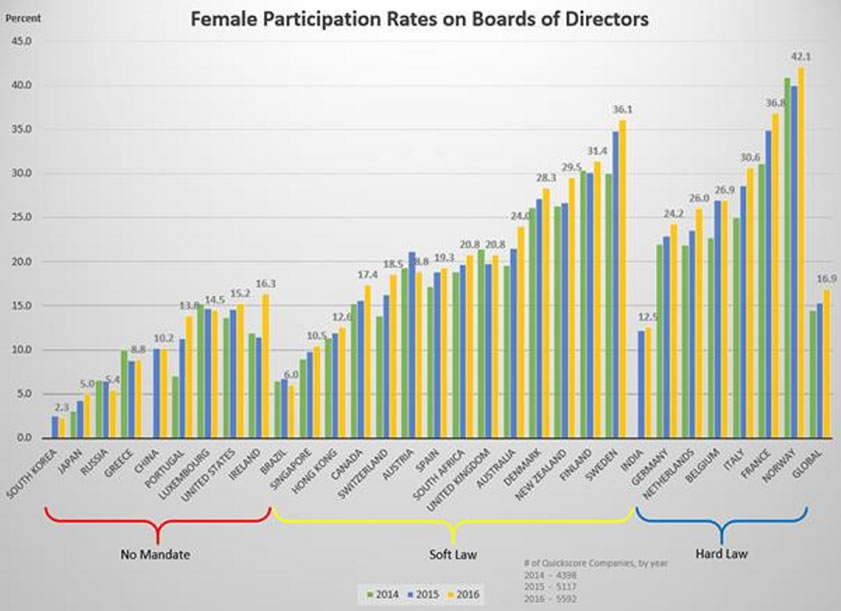

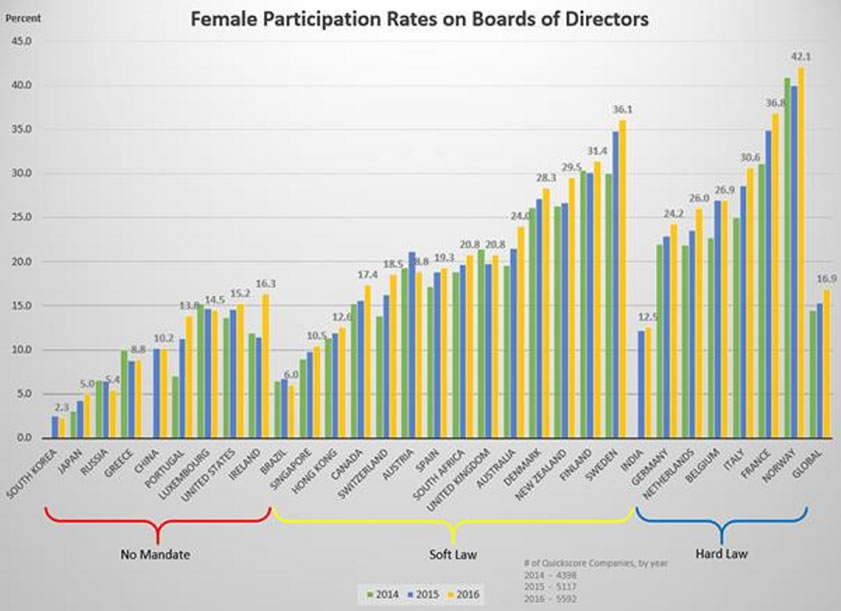

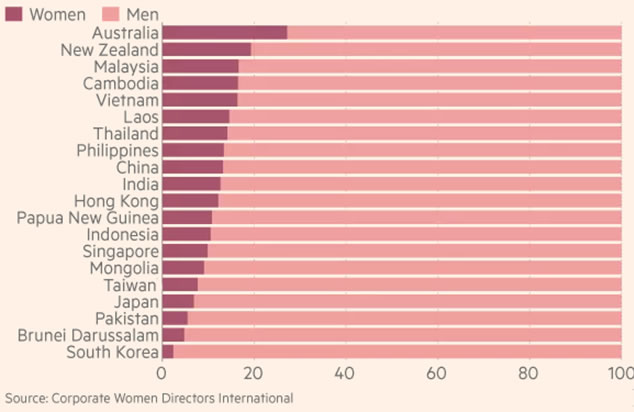

The Graph represents Global Women presentation on board.

Source: https://corpgov.law.harvard.edu/2017/01/05/gender-parity-on-boards-around-the-world/

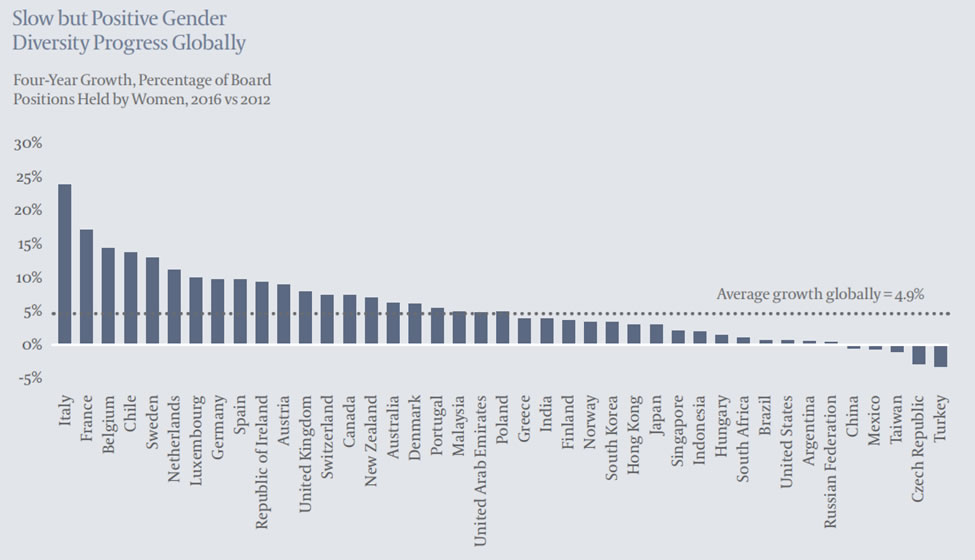

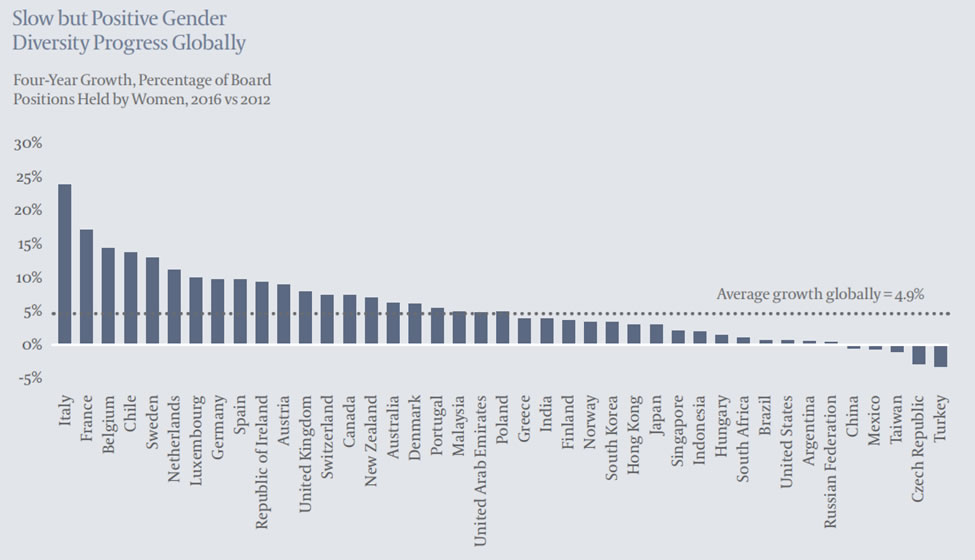

Since 2004, Egon Zehnder has tracked gender diversity through the Global Board Diversity Analysis (GBDA) to examine trends across the boardrooms of the world’s largest companies to gain a global understanding of gender diversity. The 2016 GBDA is the firm’s most comprehensive to date, evaluating board data from 1,491 public companies with market caps exceeding EUR 6bn across 44 countries. The graph shows the slow but positive gender diversity progress.

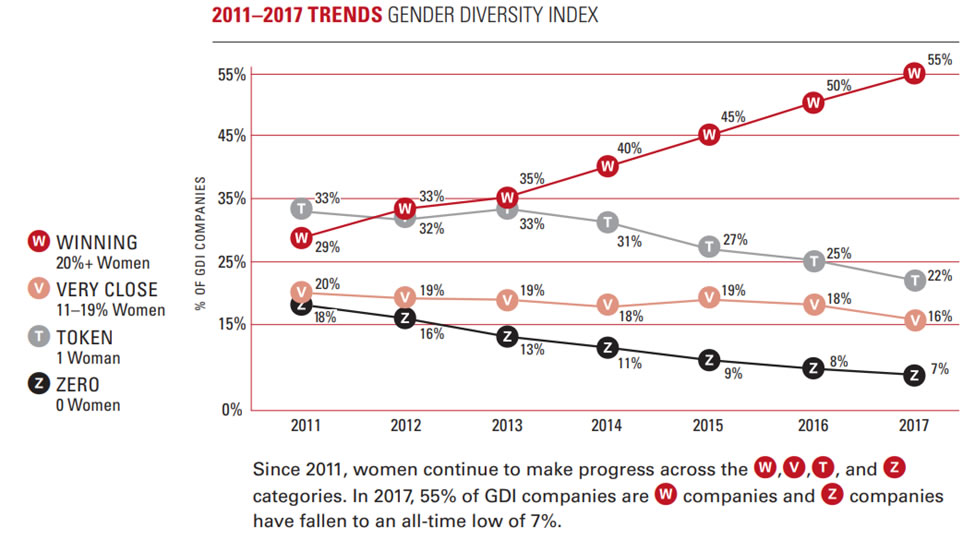

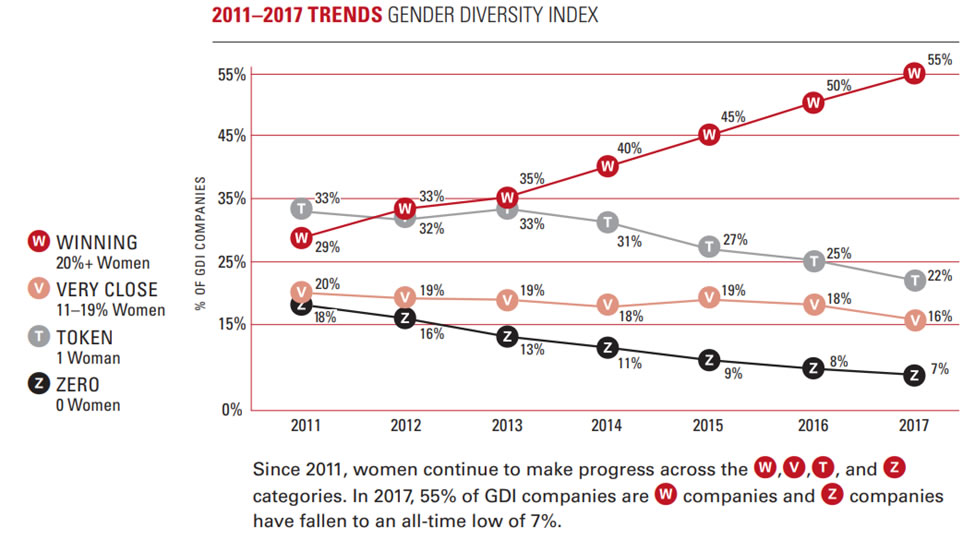

Gender Diversity Index (GDI) reports indicates that women now hold more than 20% of the board seats of Fortune 1000 companies. They also indicated that smaller companies have poorer diversity records than industry leaders. The growth of women on board in Fortune 1000 companies is increased over the years.

Source: https://www.2020wob.com/companies/2020-gender-diversity-index

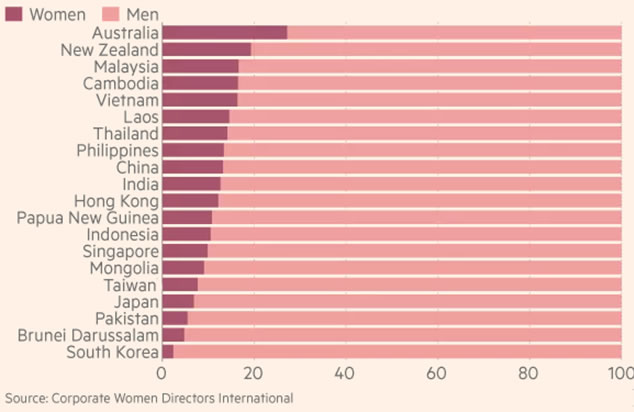

In Asia, women hold just one in eight seats on the boards of public companies. Asia lags behind Europe, where women hold 30 per cent of board seats at the top 500 companies, and North America, where fifth of board members at the 500 largest public companies are women.

There are many reasons for the low representation of women in top positions in boardrooms across Asia such as in-built corporate norms, practices of extremely long working hours and childcare burdens that still fall on women. As per “Corporate Women Directors International”, Women hold 27.2% of board seats in Australia and take lead on female directors in comparison to other countries in Asia.

In the past few years, many Asian countries such as Malaysia, India, Pakistan etc. introduced quota of woman on the board of all publicly listed companies. In 2011, Malaysia introduced a quota of 30% women directors which increased the proportion of female directors from 7.6% in 2011 to 16.6% in 2017. In 2013, India introduced a quota of at least one woman on the board of all public listed companies resulted the proportion of female from 5.5% in 2010 to 12.7% in 2017.

Women on Board in Pakistan

In 2017, Securities and Exchange Commission of Pakistan (SECP) issued the revised Code of Corporate Governance under the new Companies Act 2017 that requires Board of Directors shall have at least one female director on the Board of all public listed companies and also provide training to one female executive every year under the Directors Training Program.

The goal is set to double the percentage of women directors from 6.4% to 12.8% in three years. Currently, according to the KSE 100 index of Pakistan Stock Exchange (PSX), 69 out of 100 companies have no woman directors which include 16 out of the 20 largest listed companies. The proportion of women directors on the boards of listed companies is only 6.4% whereas women representation in Pakistan’s parliament is 17.2% and 15.8% in the labor force. It is also much lower than the proportion of women directors in the companies in S&P 500 and FTSE 100, which now ranges from 20% to 25%.

Another initiative taken to increase women representation is through the launch of The Women on Board Pakistan (WOB) by South Asian Federation of Exchanges (SAFE) in February 2017. Their mission is “to address the acute imbalance of women professionals on the corporate boards and higher management hierarchy in Pakistan”

52% of Pakistan populations consist of female but their presentation on board is very negligible. In 2017, WOB conducted a research of 505 companies listed on PSX stated that the total women directorship is 9.07% but only 0.83% is unrelated or professional women directors. The remaining proportion of 8.25% is family/ related women directors. In terms of chairperson positions, women are holding 7.13% of total chairpersons’ positions but only 0.40% (two chairperson positions) is unrelated or professional women chairpersons. Overall, women hold 11 CEO, 9 CFO, 27 company secretary positions in the 505 companies listed on PSX.

Since the start of Director Certification Program in 2007 by Pakistan Institute of Corporate Governance (PICG) only 162 women have been certified from the program. 73 of these qualified women are serving as directors on boards of listed companies.

The WOB research shows that companies in Pakistan are hiring related women to fill in the positions and shows gender diversity on their board and top management. It is the time to change the mindset and bring the professional women on board to comply with regulations of having one female director on board to create a culture of corporate change and diversity rather than inviting women to fill the quota. Catalyst conducted a research that shows that corporate boards with woman/women have a 36 percent better return of equity in comparison with those that have all-male.

Women contribution is globally recognizing in all sectors. It is time to change the mindset of gender differentiation and utilization of women potential in development and growth, politics, research and developments, etc. of country. It is very important that government and policy makers should focus on education and training for women to make them capable of playing their role in country development in all sectors. Organizations also need to incorporate gender diversity in their strategic planning and adopt in a corporate governance policies.

“If you want something said ask a man; if you want something done ask a woman” Margaret Thatcher

references:

https://www.fastcompany.com/3067983/this-is-the-state-of-gender-diversity-on-boards-around-the-world

https://30percentclub.org/assets/uploads/UK/Third_Party_Reports/2016_GBDA_DIGITAL_FINAL.pdf

https://www.ft.com/content/1b0d7abe-33ff-11e7-bce4-9023f8c0fd2e

https://www.forbes.com/sites/niallmccarthy/2016/05/19/the-countries-with-the-most-women-in-the-boardroom-infographic/#63a745da7141

http://picg.org.pk/wp-content/uploads/2015/10/Women_in_Corporate_World.pdf

https://www.secp.gov.pk/wp-content/uploads/2017/07/Press-Release-July-8-Women-directors-in-Pakistan.pdf

https://corpgov.law.harvard.edu/2017/01/05/gender-parity-on-boards-around-the-world/

http://wob.com.pk/downloads/WOB-Annual-Report.pdf